If you believed trading cards were merely a niche pastime, prepare for a reality check. What began as enthusiast swaps has erupted into a multi billion pound industry that shows no sign of slowing. Collectors, investors and casual fans alike are driving unprecedented growth in a market once confined to small conventions and bedrooms.

From Pocket Money to Pounds

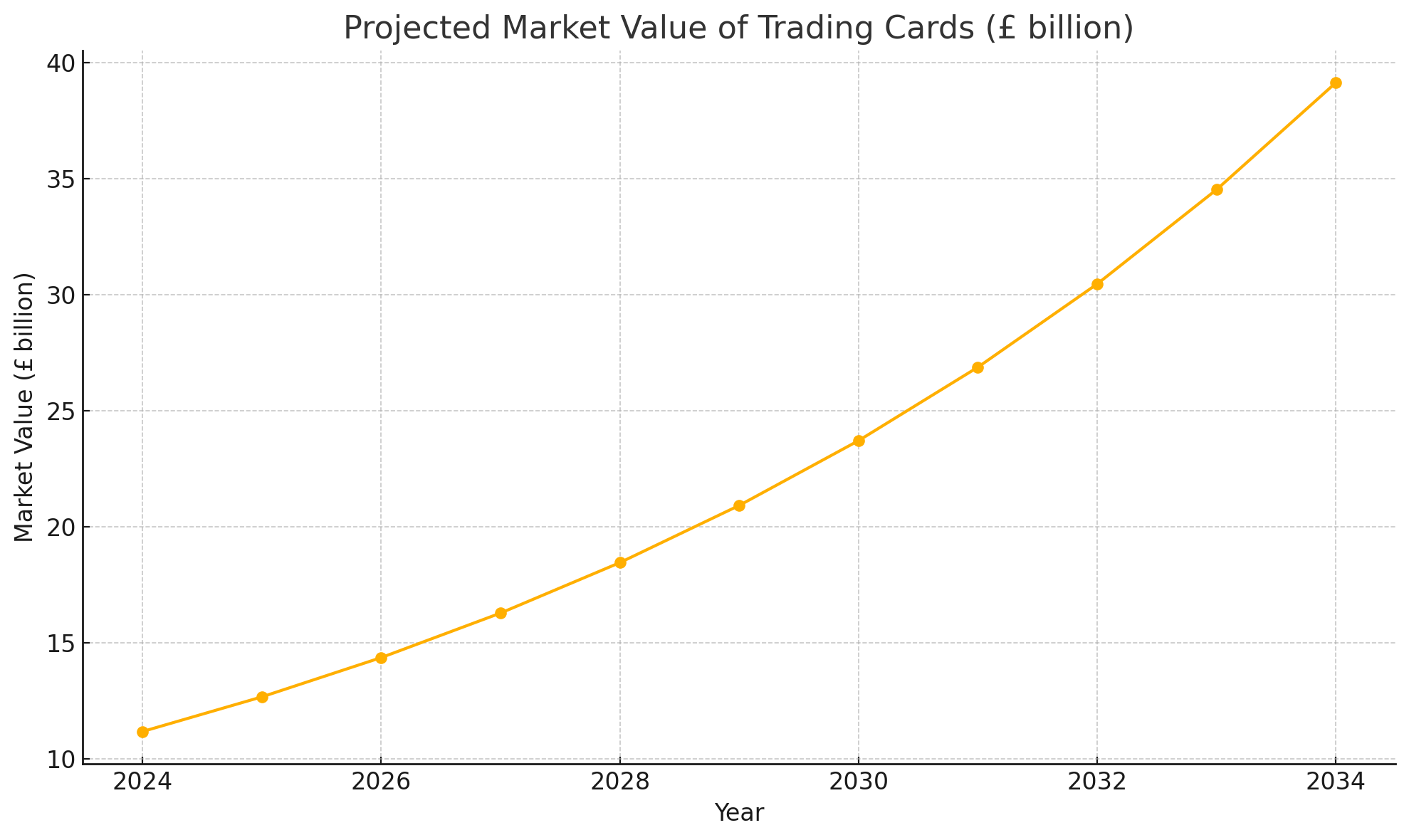

Market Decipher’s latest figures place the global sports trading cards market at around £11.19 billion in 2024, rocketing to an estimated £39.13 billion by 2034 . That equates to nearly four times its current value in just one decade. This surge has caught the attention of asset managers, hobby shops and mainstream retailers who are all scrambling to capitalise on the boom.

In the United Kingdom alone sales of premium graded cards have grown by over 150 percent in the last two years according to industry insiders.

What Is Driving the Boom?

- Nostalgia on Steroids Collectors in their thirties and forties are reigniting passions for classic sets such as Magic The Gathering, Premier League football cards and vintage baseball editions .

- Investment Potential Rare cards now fetch six figure sums at auction. What was once a pastime has become a form of alternative investment with returns that rival traditional assets .

- Digital Marketplaces Online platforms have turned trading into a round the clock global sport. You can secure a Messi rookie card at two AM in your pyjamas without leaving your sofa .

- Official Grading Services PSA, Beckett and their peers validate authenticity and condition, often multiplying a card’s value by three to five times once graded .

- Franchise Tie Ins Major brands such as Star Wars, Marvel and Disney are releasing limited edition crossover cards that command instant attention and premium prices.

The Million Pound Question

Is a crash looming? Experts say no. With a combined compound annual growth rate above 22 percent for sports memorabilia and trading cards, the market shows no signs of cooling . Even if one franchise experiences a lull, the constant introduction of new pop culture collaborations and event driven releases ensures fresh demand.

Financial advisers are beginning to recommend a small allocation to high end collectibles as part of diversified portfolios. This endorsement from the investment community only adds fuel to the fire legitimising trading cards as an asset class rather than a simple hobby.

Segment Spotlight

The growth is not uniform across all categories. Sports cards remain the largest segment but entertainment and gaming cards are closing the gap fast. According to Grand View Research the trading card game sector is expected to grow at a CAGR of eight point five percent between 2024 and 2034, outpacing traditional sports cards.

Limited edition sets tied to video game launches and blockbuster films have seen initial runs sell out in minutes. Secondary market values often climb by fifty to one hundred percent within weeks of release creating frenzy among collectors and speculators.

What This Means for Collectors

- Entry Costs Rising Prices for limited edition packs have more than doubled in three years .

- Premium on Rarity Cards graded Mint ten by PSA can command three to five times the price of ungraded equivalents turning single cards into six figure assets .

- Community Growth Conventions, online forums and live streamed pack break events have become cultural phenomena providing both social connection and trading opportunities .

- Portfolio Diversification Wealth managers are now including high end cards in alternative asset portfolios attracting new capital into the market.

Whether you are a seasoned investor trading Charizard first editions or a newcomer chasing holographic rookies the trading cards arena has left its playground origins behind and entered the big leagues. In pounds and pence this market is only just beginning its ascent.